Content

As expected, nothing is ever so simple when it comes to the world of Do Sole Proprietors Have Double Taxation? taxes. Discussing your particular situation with a trusted tax advisor or accountant can go a long way to helping you determine which business structure and tax treatment are optimal for you. Many sole proprietors want to get the tax savings of an S Corporation to avoid paying that dreaded extra share of self-employment taxes. Here’s a brief overview of how to file and pay taxes as a sole proprietor — and an explanation of when incorporating your business can save you tax dollars.

You may want to speak with a financial advisor or tax professional before making any final decisions. Read on a little more to understand the tax considerations when incorporating a business and taking a legal form. Your choice of business structure will ultimately depend on all the unique aspects of your business. Regardless of which business type you choose, taking a serious look at your legal structure is essential to set your business up for success. This situation is complicated and we encourage you to talk with a professional tax advisor prior to deciding to incorporate as an S Corporation. You can deduct your business expenses just like any other business. You are allowed to expense much of the money you spend in pursuit of profit, including operating expenses, product and advertising costs, travel expenses, and some of the cost of business-related meals.

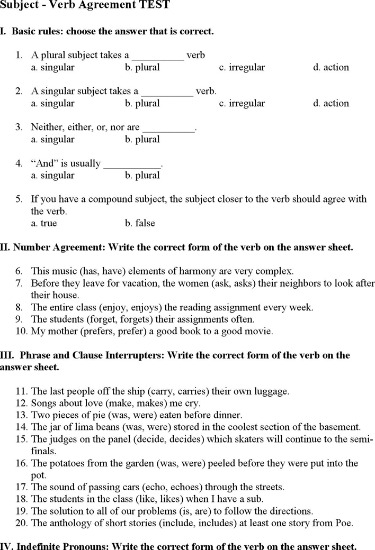

The LLC and S Corporation

Corporations, like any business, pay taxes at the end of their fiscal year. Because corporations are considered a legally separate entity from their shareholders, the corporation is taxed on its annual earnings for the year. Only C corporations and LLCs that elect to be taxed as a corporation are directly impacted by double taxation since the corporation is taxed as a separate entity. Sole proprietors, partnerships, S corporations, and LLCs do not have a separate tax, with any company earnings passed directly through to partners or LLC members to include on their personal tax. The self-employment tax rate for 2002 was 15.3% of the first $84,900 of income and 2.9% of everything over $84,900. Self-employment taxes are reported on Schedule SE, which a sole proprietor submits each year with his 1040 income tax return and Schedule C.

- The Structured Query Language comprises several different data types that allow it to store different types of information…

- Owners in LLCs are not obliged to pay off their business debts as their personal liability is limited.

- Instead, the results of the business are listed on a separate schedule of the individual income tax return .

- The DMLP was a project of the Berkman Klein Center for Internet & Society from 2007 to 2014.

This being said, in order to file your general income taxes for your sole proprietorship, you must complete the required forms on the same schedule as your personal tax returns. Therefore, you must file by April 15 unless you file an extension, which will give you until October 15 to file.

Talk to a Business Law attorney.

Instead, they will offset personal income tax through payroll tax withholding. Plus, your business can still deduct the salary, bonus and payroll tax expenses on its tax return. While the last two tax situations are not uncommon, small business owners like you are probably more concerned with how double taxation affects your corporation and how you can reduce your federal income tax burden. A sole proprietorship is the simplest and most common structure chosen to start a business. It is an unincorporated business owned and run by one individual with no distinction between the business and you, the owner.

Why a sole proprietorship is best?

Minimal paperwork and low set-up costs are two major benefits of having a sole proprietorship. In addition, there is the ease of maintaining it. In fact, according to the SBA, it's the simplest and least expensive business type you can establish.

A solid method is to maintain distinct checkbooks related to your https://intuit-payroll.org/ life’s costs and your business’s costs. Pay for all your business-related expenses from a linked business-only account. The offers that appear in this table are from partnerships from which Investopedia receives compensation.